Mandatory e-Invoicing: time to get on board

E-InvoicingAction required

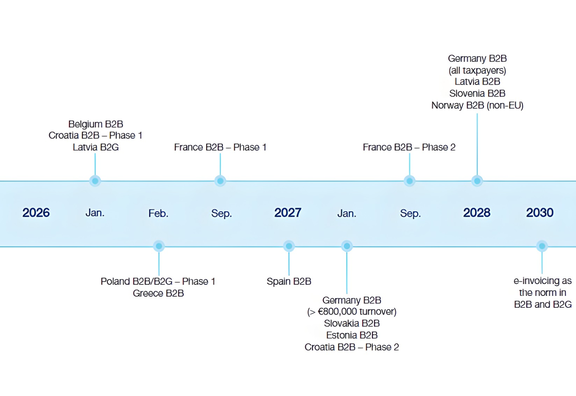

The foundation has been laid, and e-invoicing is gaining momentum. After the Council of EU Finance Ministers (ECOFIN) adopted the ViDA directive last year and the European Parliament approved the ViDA package this year, many countries have now entered the implementation phase. Germany began introducing mandatory e-invoicing — with transition periods and exceptions — at the start of 2025. More countries are set to follow: Croatia, under its working title Fiskalizacija 2.0, and Belgium plan to introduce corresponding B2B e-invoicing requirements as early as January 1, 2026; Poland will follow on February 1; and several other member states are already preparing their own rollouts (see overview). According to the current version of the ViDA directive, the key deadline for mandatory issuance of e-invoices within the European Union is July 1, 2030.

In many EU countries, structured electronic invoices are currently mandatory only in the B2G sector. Nevertheless, companies should already be taking proactive steps, especially if they operate in countries that are now introducing mandatory e-invoicing. For companies based outside these countries, there is currently no obligation to report cross-border B2B invoices — for example, invoices issued to Polish business partners — to the Polish authorities under the new KSeF rules. The situation changes, however, when a company has its own subsidiary or permanent establishment in Poland. In that case, any invoice issued by this entity must be created and transmitted in full compliance with KSeF requirements.

In Croatia, the new regulation goes beyond the introduction of B2B e-invoicing. Among other measures, it also includes mandatory electronic archiving of invoices as well as digital bookkeeping

E-Invoicing in the EU: Overview of upcoming regulations

E-invoicing: far more than going paperless

As highlighted by the example of Croatia, e-invoicing goes far beyond replacing paper or PDF invoices. At its core, it is about achieving fully digital capture, recording, and archiving of B2B business transactions. One goal of this digital transformation is to reduce VAT fraud, which cost EU member states an estimated € 61 billion in 2021 alone, according to the “VAT Gap Report.” At the same time, the introduction of e-invoicing opens the door to significant process optimization, efficiency gains, and cost reductions.

EDITEL CEO Gerd Marlovits comments: “Creating an invoice is ultimately just one link in a chain of transactions between business partners. The obligation to transmit structured e-invoices will further accelerate the digitalization of upstream and downstream processes — from ordering and delivery confirmation to posting and archiving.” An integrated EDI solution ensures seamless data exchange, both internally with ERP or merchandise management systems and externally with business partners.

From obligation to opportunity

For this reason, Mr. Marlovits advises companies to view the legal obligation to issue structured e-invoices as an opportunity to optimize their digital processes and to use it as a moment to review all upstream and downstream workflows as well: “Our experts have decades of experience implementing projects of this kind.” Since ViDA leaves the specific design to individual member states, EDITEL has established its own E-Invoicing Competence Center, which analyzes the often-complex national regulations and provides a clear overview of the various legal and technical requirements in each country. This enables companies across the EU and beyond to receive forward-looking support as they transition to the new rules.

You can find more information about e-invoicing and country-specific solutions online here: